- WORLD EDITIONAustraliaNorth AmericaWorld

Investing News NetworkYour trusted source for investing success

April 27, 2025

European Metals Holdings Limited (ASX & AIM: EMH, OTCQX: EMHXY, ERPNF and EMHLF) (“European Metals” or the “Company”) is pleased to announce the following update in relation to grant funding by the European Union for the Cinovec Project (“Cinovec” or “the Project”).

Highlights

- Czech selection panel of the managing authority for the EU Just Transition Fund (“JTF”) has approved a CZK 800 million (US$ 36 million) grant to the Cinovec Project.

- JTF grant is conditional on the Project Environmental Impact Assessment (“EIA”) being submitted by 31st December 2025 and approval of the EIA by the Czech Ministry of Environment by 30th June 2026.

- The Cinovec Project is a Strategic Project under the EU Critical Raw Materials Act (“CRMA”).

- Cinovec mineral deposit is designated a Strategic Deposit by the Czech government for the purposes of the Czech Construction Code.

Just Transition Fund

Further to the Project being declared a “Strategic Project” under the (refer to the Company’s ASX/AIM releases dated 26/25 March 2025) (“Cinovec Declared a Strategic Project Under EU Critical Raw Materials Act”), the final approval of financial support for the Project under the JTF represents a further important confirmation of support from European and Czech institutions.

The terms and conditions of the JTF grant will be detailed in the contract between the grant provider (Czech Ministry of Environment) and the beneficiary, the Cinovec Project holding company, Geomet s.r.o.

The contract will detail milestones, including the EIA and construction permitting timetable, as well as the conditions for advance payments and reimbursement of costs incurred by the beneficiary. The conditions will also include how the Project's progress will be reported to the Czech Ministry of Environment which is the managing authority for JTF projects.

Keith Coughlan, Executive Chairman, commented:“We welcome this final confirmation of the significant JTF grant. The grant funding will be utilised to fast track a number of critical path items with regards to the Cinovec Project. This confirmation builds on recent project momentum, and is another clear indicator of the support the European Union and the Czech government is willing to provide to assist in getting Cinovec into production in the timeliest manner possible.”

Strategic Project Status

The declaration of the Cinovec Project as a Strategic Project under the CRMA represents confirmation of the advanced stage of development of the Project. The Definitive Feasibility Study (“DFS”) for the Project is progressing towards completion in mid-2025, with the EIA to be completed and submitted for approval by the end of 2025. It is expected that the Czech Ministry of Environment will approve the EIA by mid-2026, with final construction permitting expected to follow within the required time frame of 24 months as set out in CRMA.

Being named a Strategic Project means that the project is considered highly important for ensuring a secure and sustainable supply of critical raw materials in Europe. Such projects must have a credible timeframe and production volumes and have to be implemented with the highest ESG credentials. These projects are essential for the green and digital transition, as well as for the resilience of the defence and aerospace sectors. The Cinovec Project, comprising of the largest hard rock lithium resource in the EU by far, is vital to achieve the EU’s objectives on Climate Change.

Click here for the full ASX Release

This article includes content from European Metals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

EMH:AU

The Conversation (0)

Sort by

01 May

European Metals Receives US$36 Million Grant for Cinovec Lithium-Tin Project

European Metals Holdings (ASX:EMH,LSE:EMH,OTCQX:EMHXY) confirmed the approval of a US$36 million Just Transition Fund (JTF) grant for its Cinovec lithium-tin project on Monday (April 28).

The JTF is run by the European Commission, supporting projects that align with the economic diversification and reconversion of concerned territories such as Bulgaria, the Czech Republic and Hungary.

JTF states on its website that the number of supported projects varies annually, depending on the proposals. The grant also forms part of the European Union’s efforts to transition to clean energy and achieve climate goals.

Cinovec was chosen as it was designated as a strategic project under the Critical Raw Minerals Act in March, underlining its importance in Europe’s journey toward securing stable supply of critical raw minerals. It was also declared a strategic deposit by the Czech government, a designation that accelerates certain permitting processes.

"The grant funding will be utilised to fast track a number of critical path items with regards to the Cinovec Project,” commented European Metals Executive Chair Keith Coughlan in a press release. “This confirmation builds on recent project momentum and is another clear indicator of the support the European Union and the Czech government is willing to provide to assist in getting Cinovec into production in the timeliest manner possible."

Located approximately 100 kilometres northwest of Prague in the Ústí region of the Czech Republic, Cinovec was acquired by European Metals in 2014 through a 100 percent purchase of its exploration rights. It is said to host the largest lithium resource in Europe, and is regarded as one of the largest undeveloped tin resources in the world.

Once operational, it is expected to produce 29,386 tonnes per annum of battery-grade lithium oxide over a 25 year life.

As per a 2021 JORC-compliant resource estimate, Cinovec holds 708 million tonnes at an average grade of 0.42 percent lithium oxide for a total of 7.39 million tonnes of lithium carbonate equivalent.

The results of a definitive feasibility study for Cinovec are expected by mid-2025. Should the project successfully enter production, it could assist in supporting the EU's objective of achieving lithium self-sufficiency by 2030.

Don’t forget to follow us @INN_Australia for real-time news updates!

Securities Disclosure: I, Gabrielle de la Cruz, hold no direct investment interest in any company mentioned in this article.

Keep reading...Show less

01 May

Atlantic Lithium

Investor Insight

Atlantic Lithium is advancing Ghana’s first lithium mine at Ewoyaa, a fully permitted, strategically located project ready to supply global battery markets. With strong local support and a clear path to production, the company is positioned for near-term growth and long-term impact in the energy transition.

Overview

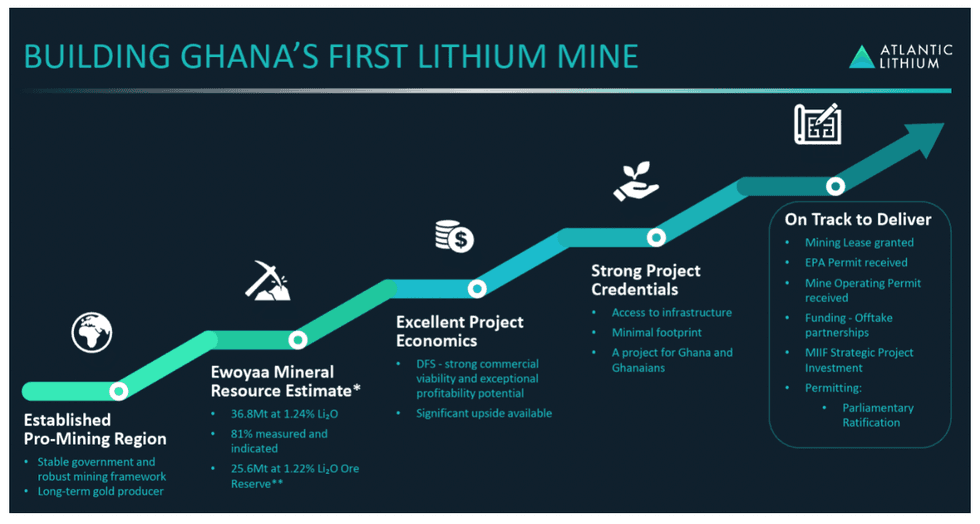

Atlantic Lithium (AIM:ALL,ASX: A11,GSE:ALLGH,OTCQX: ALLIF) is an Africa-focused lithium exploration and development company advancing its flagship Ewoyaa Lithium project through to production as Ghana’s first lithium mine.

Despite its long mining history, favourable regulatory climate and stable political backdrop, Ghana remains largely overlooked as an investment jurisdiction for battery metals. Situated on the West African coast, the country boasts a strong strategic location, between Europe, the Americas and Asia, to serve the global battery metals market. Ghana is also home to an abundance of mineral wealth, with c. 180,000 tonnes of estimated lithium resources.

Atlantic Lithium intends to produce spodumene concentrate capable of conversion to lithium chemicals for use in electric vehicle batteries and energy storage, aiming to support global decarbonisation.

A definitive feasibility study (DFS) released in June 2023 shows that Ewoyaa has demonstrable economic viability, low capital intensity and excellent profitability.

Through simple open-pit mining, three-stage crushing and conventional Dense Medium Separation (DMS) processing, the DFS outlines the production of 3.6 Mt of spodumene concentrate over a 12-year mine life, which will make it one of the largest spodumene mines by production capacity globally.

The Ewoyaa Lithium Project was awarded a Mining Lease in October 2023, an EPA Permit in September 2024, and a Mine Operating Permit in October 2024.

Having secured all of the permits required to begin construction, Atlantic Lithium currently awaits parliamentary ratification of the Ewoyaa Mining Lease, which was issued by the Ministry of Lands and Natural Resources in October 2023.

The JORC mineral resource estimate at Ewoyaa now stands at 36.8 million tons (Mt) at 1.24 percent lithium oxide, 81 of which is now in the higher confidence measured and indicated categories (3.7 Mt at 1.37 percent lithium oxide in the measured category, 26.1 Mt at 1.24 percent lithium oxide in the indicated category, and 7 Mt at 1.15 percent lithium oxide in the Inferred category).

The residents of the project-affected communities in Ghana’s Central Region have voiced their strong support from the advancement of the project towards production.

Atlantic Lithium’s Ewoyaa Lithium Project site

Project Funding

The development of the project is co-funded under an agreement with NASDAQ and ASX-listed Piedmont Lithium (ASX: PLL), under which Piedmont is required to contribute the first US$70m of Development Costs, as defined in the agreement, as sole funding to complete its earn-in to 50% of Atlantic Lithium's ownership of the project, with all Development Costs and other project expenditure equally shared by both Atlantic Lithium and Piedmont thereafter.

In accordance with the agreement, which is intended to result in the construction of the project and the achievement of initial spodumene production, Piedmont will earn the rights to 50 percent of all spodumene concentrate produced at Ewoyaa at market rates, providing a route to consumers through several major battery manufacturers, including Tesla.

The Minerals Income Investment Fund (MIIF), Ghana’s minerals sovereign wealth fund, has also agreed to invest US$27.9 million at project-level to acquire a 6% contributing interest in the project and Atlantic Lithium’s Ghana Portfolio. The project-level investment represents Stage 2 of its Strategic Investment in the company.

This follows Stage 1 of its Strategic Investment, comprising MIIF’s Subscription for US$5 million Atlantic Lithium shares, which was completed in January 2024, resulting in MIIF becoming a major strategic shareholder in the company.

MIIF’s Strategic Investment is intended to expedite the development of the project towards production.

In addition, noting that Ewoyaa is one of the most advanced undeveloped hard rock lithium projects globally, Atlantic Lithium continues to engage with parties across the battery metals supply chain who express inbound interest in lithium products from Ewoyaa.

In doing so, Atlantic Lithium aims to expedite and de-risk the development of the Project, realise attractive terms for any offtake contracted and secure well-credentialled partners that will support the company's and Ghana's objectives of supplying lithium into the global market.

Ghana

Ghana is a well-established mining region with access to reliable, existing infrastructure and a significant mining workforce. There are currently 16 operating mines in the country.

Already the largest taxpayer and employer in Ghana’s Central Region, Atlantic Lithium is expected to provide direct employment to over 900 personnel at Ewoyaa and, through its community development fund, whereby 1 percent of revenues will be allocated to local initiatives, will deliver long-lasting benefits to the region and Ghana.

Through its proven lithium discovery, exploration and evaluation methodologies, Atlantic Lithium has the potential to capitalise on its extensive exploration portfolio and deliver upon its objectives of becoming a leading producer of lithium in West Africa.

Company Highlights

- A lithium exploration and development company operating in West Africa, Atlantic Lithium is set to deliver its flagship Ewoyaa Lithium Project as Ghana’s first lithium-producing mine.

- The June 2023 definitive feasibility study for the Ewoyaa Lithium Project indicates the production of 3.6 Mt of spodumene concentrate over a 12-year mine life (steady state production of 365,000 tonnes per annum), making it one of the largest mines by production capacity globally.

- The project was awarded a Mining Lease in October 2023, an EPA Permit in September 2024, and a Mine Operating Permit in October 2024. The project is funded under a co-development agreement with Piedmont Lithium.

- The DFS confirms Ewoyaa’s robust commercial viability and profitability potential, driven by the project’s low capital and operating cost profile.

- The project has an updated mineral resource estimate of 36.8 Mt at 1.24 percent lithium oxide.

- Atlantic Lithium holds a portfolio of lithium projects within 509 sq km and 774 sq km of granted and under-application tenure across Ghana and Côte d'Ivoire respectively.

Key Assets

Ewoyaa

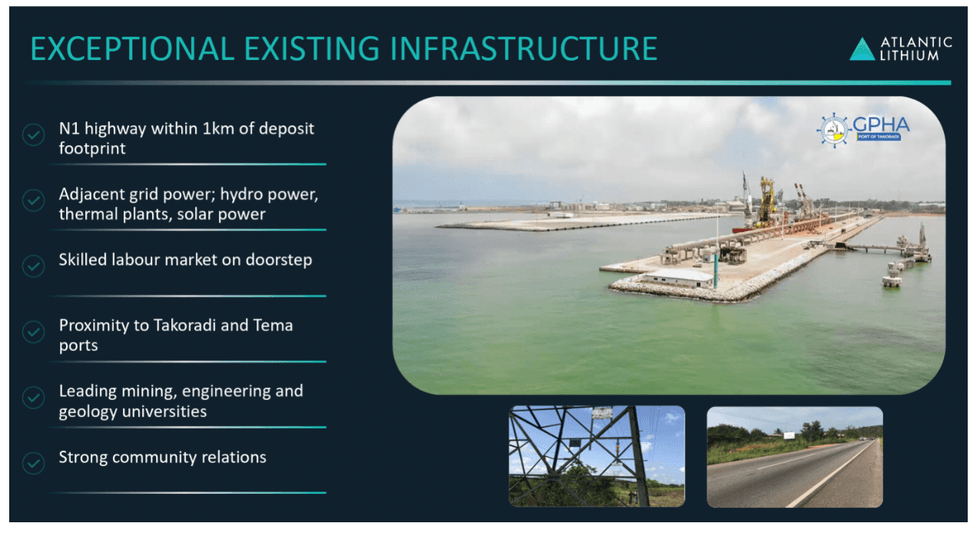

Atlantic Lithium's flagship Ewoyaa Lithium Project is situated within 110 kilometres of Takoradi Port and 100 kilometres of Accra, with access to excellent infrastructure and a skilled local workforce.

Atlantic Lithium has been granted a Mining Lease, an EPA Permit and a Mine Operating Permit in respect of the project in October 2023, September 2024 and October 2024, respectively. The company is currently advancing the project towards production.

Highlights:

- Promising DFS Results: Atlantic Lithium's DFS reaffirmed Ewoyaa’s low capital and operating profile and robust profitability. Highlights include:

- Estimated 12-year life of mine, producing 3.6 Mt spodumene concentrate.

- 365 ktpa steady state production

- Robust US$675/t All in sustaining cost and US$377 C1 cash cost.

- Favourable Location: The project's starter pits are positioned within one kilometre of its processing plant. Additionally, Ewoyaa has access to reliable existing infrastructure, located within 800 metres from the N1 highway and adjacent to grid power.

- Promising Reserves: Ewoyaa's current mineral resource estimate (as of July 2024) at is 36.8 Mt at 1.24 percent lithium oxide, of which 81 percent is now in the higher confidence measured and indicated categories (3.7 Mt at 1.37 percent lithium oxide in the measured category, and 26.1 Mt at 1.24 percent lithium oxide in the indicated category, and 7 Mt at 1.15 percent lithium in the inferred category).

- Potential for Further Exploration: There remains significant exploration potential within the company’s 509km2 tenure in Ghana.

- Strong Partnerships: Atlantic Lithium has an offtake deal with Piedmont Lithium, which itself has offtake agreements with both Tesla and LG Chem. Ghana’s Minerals Income Investment Fund has also agreed a Strategic Investment in the company to expedite the development of the project.

- Positive Presence: Atlantic Lithium will generate significant economic benefits for the region. Once operational, the project is expected to employ over 900 personnel and deliver significant value to Ghana, including through taxes, royalties, employment and local procurement.

Côte d'Ivoire

Atlantic Lithium wholly owns two contiguous exploration licences covering an area of c. 771 square kilometres in the mining-friendly jurisdiction of Côte d'Ivoire, which borders Ghana on the West African coast. The two licences offer the company with exclusive rights to apply its proven lithium exploration expertise over new, untested and highly prospective tenure, where the company considers there to be significant lithium discovery potential. The licences, which are located within 100 kilometres of the country's economic capital, Abidjan, are incredibly well-served, with extensive road infrastructure, well-established cellular network and high-voltage transmission lines.

Management Team

Neil Herbert - Executive Chairman

Neil Herbert is a fellow of the Association of Chartered Certified Accountants and has over 30 years of experience in finance. He has been involved in growing mining and oil and gas companies, both as an executive and as an investor, for over 25 years.

Until May 2013, he was co-chairman and managing director of AIM-quoted Polo Resources, a natural resources investment company. Prior to this, Herbert was a director of resource investment company Galahad Gold, from which he became finance director of its most successful investment, the start-up uranium company UraMin, from 2005 to 2007. During this period, he worked to float the company on AIM and the Toronto Stock Exchange in 2006, raised US$400 million in equity financing and subsequently negotiated the sale of the group for US$2.5 billion.

Herbert has held board positions at a number of resource companies where he has been involved in managing numerous acquisitions, disposals, stock market listings and fundraisings. He holds a joint honours degree in economics and economic history from the University of Leicester.

Keith Muller - Chief Executive Officer

Keith Muller is a mining engineer with over 20 years of operational and leadership experience across domestic and international mining, including in the lithium sector. He has a strong operational background in hard rock lithium mining and processing, particularly in DMS spodumene processing.

Before joining Atlantic Lithium, he held roles as both a business leader and general manager at Allkem, where he worked on the Mt Cattlin lithium mine in Western Australia and, prior to that, Muller served as operations manager and senior mining engineer at Simec.

Muller holds a Master of Mining Engineering from the University of New South Wales and a Bachelor of Engineering from the University of Pretoria. He is also a member of the Australian Institute of Mining and Metallurgy, the Board of Professional Engineers of Queensland, and the Engineering Council of South Africa.

Amanda Harsas - Finance Director and Company Secretary

Amanda Harsas is a senior finance executive with a demonstrable track record and over 25 years’ experience in strategic finance, business transformation, commercial finance, customer and supplier negotiations and capital management. Before joining Atlantic Lithium, she worked in several sectors, including healthcare, insurance, retail and professional services, across Asia, Europe and the U.S. Harsas holds a Bachelor of Business from the University of Technology, Sydney and is a member of Chartered Accountants Australia and New Zealand and the Australian Institute of Company Directors.

Kieran Daly - Non-executive Director

Kieran Daly is the executive of Growth and Strategic Development at Assore. He holds a BSc Mining Engineering from Camborne School of Mines (1991) and an MBA from Wits Business School (2001) and worked in investment banking/equity research for more than 10 years at UBS, Macquarie and Investec, prior to joining Assore in 2018.

Daly spent the first 15 years of his mining career at Anglo American’s coal division (Anglo Coal) in a number of international roles including operations, sales and marketing, strategy and business development. Among his key roles were leading and developing Anglo Coal's marketing efforts in Asia and to steel industry customers globally. He was also the Global Head of Strategy for Anglo Coal immediately prior to leaving Anglo in 2007.

Christelle Van Der Merwe - Non-executive Director

Christelle Van Der Merwe is a senior manager in the growth & strategic development team at Assore. She has been a geologist for Assore since 2013 and is involved with the strategic and resource investment decisions of the company. Van Der Merwe is a member of SACNASP, the GSSA and AUSIMM.

Jonathan Henry - Independent Non-executive Director

Jonathan Henry is an experienced non-executive director, having held various leadership and board roles for nearly two decades. Henry has significant expertise working across capital markets, business development, project financing, key stakeholder engagement, and the reporting and implementation of ESG-focused initiatives. Henry has a wealth of experience projects towards production and commercialisation to deliver shareholder value.

Henry previously served as non-executive chair and executive chair of Giyani Metals Corporation, a battery development company advancing its portfolio of manganese oxide projects in Botswana, executive chair and non-executive director at Ormonde Mining, non-executive director at Ashanti Gold Corporation, president, director and chief executive officer at Gabriel Resources and various roles, including chief executive officer and managing director, at Avocet Mining. He holds a BA (Hons) in Natural Sciences from Trinity College, Dublin.

Michael Bourguignon – Head of Capital Projects

Michael Bourguignon is a distinguished project management professional with a rich history of leading significant initiatives in the mining and energy sectors. Most recently, he served as the COO at Evolution Energy Minerals in Tanzania, where he managed the optimisation and update of the Definitive Feasibility Study, managed the Front-End Engineering Design package, and oversaw the completion of the Relocation Action Plan and other community-related works.

Prior to this, Bourguignon worked with Rio Tinto in Australia as a consulting construction manager, as well as Glencore’s Mopani Copper Mines in Zambia, where he was the project director for the Mopani Synclinorium Concentrator, and Syrah’s Balama Graphite Mine in Mozambique, where he was project director. He has also previously worked in Ghana and Cote d’Ivoire with Perseus Mining. Bourguignon holds an MBA from Murdoch University and is a member of the Australian Institute of Project Management.

Andrew Henry – General Manager, Commercial and Finance

Andrew Henry is an accomplished general manager with over a decade’s experience in the operational mining sector, specialising in strategy, planning and analysis, contracts, large-scale project development and site operations.

Before joining Atlantic Lithium, Henry held the role of commercial manager at global lithium chemicals company Allkem and, prior to that, he spent over four years with major gold mining company Newcrest Mining.

Henry holds a Bachelor of Commerce from the University of South Australia and is a member of CPA Australia.

Ahmed-Salim Adam – General Manager, Operations

Ahmed-Salim Adam is an experienced mining general manager with over 15 years of experience leading various large-scale projects in Ghana across all stages of mine development, production, and closure, with a focus on safety and sustainability.

Adam has previously held a number of leadership roles, including as senior consultant of Metallurgy at GEOMAN Consult Ltd, as a director for FGR Bogoso Prestea’s Refractory Project and as general manager at Golden Star Resources.

He holds a MPhil Minerals Engineering and a Bachelor of Science (Hons) in Mineral Engineering, both from the University of Mines and Technology, Ghana. He is also a member of The Institute of Materials, Minerals and Mining (IOM3) in the United Kingdom and the Australasian Institute of Mining and Metallurgy (AusIMM) in Australia.

Belinda Gethin – General Manager, Corporate Finance and Company Secretary

Belinda assumed the role of general manager, corporate - finance and company secretary in January 2024, having initially joined the company as financial reporting manager in June 2023. To her role at Atlantic Lithium, Gethin brings a wealth of experience in all aspects of statutory, financial and corporate reporting, including the preparation of financial statements and accounting for complex transactions. Before joining Atlantic Lithium, Gethin worked as the chief financial officer for Lumus Imaging and, prior to that, as the group reporting manager at Healius. Gethin is a chartered accountant and holds a Bachelor of Commerce from UNSW in Sydney, Australia.

Iwan Williams – General Manager, Exploration

Iwan Williams is an exploration geologist with over 20 years' experience across a broad range of commodities, principally iron ore, manganese, gold, copper (porphyry and sed. hosted), PGE's, nickel and other base metals, as well as chromitite, phosphates, coal and diamond.

Williams has extensive southern and West African experience and has worked in Central and South America. His experience includes all aspects of exploration management, project generation, opportunity reviews, due diligence and mine geology. He has extensive studies experience, having participated in the delivery of multiple project studies including resource, mine design criteria, baseline environmental and social studies and metallurgical test-work programmes. He is very familiar with working in Afric,a having spent 23 years of his 28-year geological career in Africa. Williams is a graduate of the University of Liverpool.

Abdul Razak – Exploration Manager, Ghana

Abdul Razak has extensive exploration, resource evaluation and project management experience throughout West Africa with a strong focus on data-rich environments. He has extensive gold experience, having worked throughout Ghana with AngloGold Ashanti, Goldfields Ghana, Perseus and Golden Star, as well as international exploration and resource evaluation experience in Burkina Faso, Liberia, Ivory Coast, Republic of Congo, Nigeria and Guinea.

Razak is an integral member of the team, managing all site activities including drilling, laboratory, local teams, geotech and hydro, community consultations and stakeholder engagements and was instrumental inthe establishment of the current development team and defining Ghana’s maiden lithium resource estimate.

Keep reading...Show less

30 April

Atlantic Appeals for Fiscal Re-evaluation for Ewoyaa Lithium Project

Atlantic Lithium (ASX:A11,LSE:AAL,OTCQX:ALLIF) is appealing to the Ghanaian government to re-evaluate fiscal terms regarding its flagship Ewoyaa lithium project, which is located in the country.

The company’s board of directors acknowledged media reports on the situation in a press release late last week, saying it wants to ensure the successful development of the asset.

Atlantic notes that lithium prices have significantly declined since the mining lease for Ewoyaa was granted in October 2023, and is urging officials to adjust fiscal terms based on current price levels. Lithium prices remained low in 2024, and the downtrend has continued in 2025, with some price segments falling to four year lows.

Adam Webb, head of battery raw materials at Benchmark Mineral Intelligence, said at the Benchmark Summit in March that lithium carbonate prices are expected to remain about where they are, at US$10,400 per metric ton.

“But if we look further ahead, from 2026 onwards, that market is switching into the deficit, albeit quite small to start with, and that will end up being supportive of prices,” he explained at the Toronto-based event.

Australian spot spodumene concentrate prices have also declined.

Starting the year at the US$990 per metric ton level, values contracted through the first quarter of 2025 and are now sitting at the US$765 level, a 23.5 percent drop from January 2024's price of US$1,000.

Atlantic said that despite this price environment, it is dedicated to “working in a spirit of partnership” with the Ghanaian government and its host communities to ensure that Ewoyaa becomes a reality.

The project is set to be Ghana’s first lithium-producing mine, and could become one of the top 10 largest spodumene concentrate producers globally. A resource estimate updated in July 2024 outlines 36.8 million metric tons at 1.24 percent lithium oxide, while a June 2023 definitive feasibility study shows Ewoyaa has the capacity to produce 3.6 million metric tons of spodumene concentrate over a 12 year mine life.

“While current lithium prices present headwinds, we believe that through collaboration and prudent fiscal measures, we can advance Ewoyaa to production and deliver lasting value for all stakeholders,” said Executive Chair Neil Herbert.

Atlantic said it is working closely with the Ghanaian government and local communities to progress the project to production and ensure long-term benefits for Ghana, such as critical revenue, local employment and skills development.

In August 2023, Piedmont Lithium (ASX:PLL,NASDAQ: PLL) committed to funding Ewoyaa, acquiring a 22.5 percent stake in the project. The company continues to assist Atlantic in advancing the project.

Speaking with the media earlier this week, Atlantic Lithium CEO Keith Muller said that there is “no doubt” in his mind that Ewoyaa will be built.

Don’t forget to follow us @INN_Australia for real-time news updates!

Securities Disclosure: I, Gabrielle de la Cruz, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: Atlantic Lithium is a client of the Investing News Network. This article is not paid-for content.

Keep reading...Show less

24 April

7 Biggest Lithium-mining Companies in 2025

For a long time, most of the world's lithium was produced by an oligopoly of US-listed producers. However, the sector has transformed significantly in recent years.

Interested investors should cast a wider net to look at global companies — in particular those listed in Australia and China, as companies in both countries have become major players in the industry.

While Australia has long been a top-producing country when it comes to lithium, China has risen quickly to become not only the top lithium processor and refiner, but also a major miner of the commodity. In fact, China was the third largest lithium-producing country in 2024 in terms of mine production, behind Australia and Chile.

Chinese companies are mining in other countries as well, including top producer Australia, where a few are part of major lithium joint ventures. For example, Australia’s largest lithium mine, Greenbushes, is owned and operated by Talison Lithium, which is 51 percent controlled by Tianqi Lithium Energy Australia, a joint venture between China’s Tianqi Lithium (SZSE:002466,HKEX:9696) and Australia’s IGO (ASX:IGO,OTC Pink:IPDGF). The remaining 49 percent stake in Talison is owned by Albemarle (NYSE:ALB). Joint ventures can offer investors different ways to get exposure to mines and jurisdictions.

Mergers and acquisitions are common in the lithium space, with the biggest news in the industry recently being Rio Tinto's (ASX:RIO,NYSE:RIO,LSE:RIO) acquisition of Arcadium Lithium for US$6.7 billion in March of this year. The acquisition transforms Rio Tinto into a global leader in lithium production with one of the world’s largest lithium resource bases.

As for Chile, the country's lithium landscape is changing following the December 2024 announcement that as a part of its National Lithium Strategy toward public-private partnerships, the government opened up the process of assigning special lithium operation contracts to a total of 12 priority areas.

All in all, lithium investors have a lot to keep an eye on as the space continues to shift. Read on for an overview of the current top lithium-producing firms by market cap. Data was current as of April 4, 2025.

Biggest lithium-mining stocks

1. Rio Tinto (ASX:RIO,NYSE:RIO,LSE:RIO)

Market cap: US$99.83 billion

Share price: AU$112.70

Rio Tinto, a global powerhouse in the resource sector for decades, is mostly known for its iron and copper production. However, in recent years, the mining giant has been expanding its position in the world’s lithium market.

In March 2025, the company cemented its position as one of the biggest lithium-producing companies in the world with the US$6.7 billion all-cash acquisition of Arcadium Lithium, the lithium giant formed after the US$10.6 billion merger of lithium majors Allkem and Livent.

Following the acquisition, Rio Tinto is consolidating Arcadium's portfolio with its own lithium projects under the name Rio Tinto Lithium. Arcadium's portfolio includes the Salar del Hombre Muerto and Olaroz lithium brine operations in Argentina, as well as the Mount Cattlin hard-rock mine in Western Australia, which is entering care and maintenance in the second half of this year. It also has lithium hydroxide production capacity in the US, Japan and China.

At the time, Rio Tinto said it will increase its lithium carbonate equivalent production capacity to over 200,000 metric tons (MT) annually by 2028.

Lithium acquisitions are not new to Rio Tinto. In 2022, it acquired the Rincon project in Argentina from Rincon Mining. Rincon has an expected annual capacity of 53,000 MT of battery-grade lithium carbonate over a 40 year mine life, although Rio Tinto plans to expand production at the site to 60,000 MT per year. A pilot battery-grade lithium carbonate plant is scheduled for completion in H1 2025.

As of March 2025, Rio Tinto is also reportedly in talks to develop the Roche Dure lithium deposit in the Democratic Republic of Congo, one of the world's largest hard-rock lithium deposits.

2. SQM (NYSE:SQM)

Market cap: US$10.93 billion

Share price: US$37.05

SQM has five business areas, ranging from lithium to potassium to specialty plant nutrition. Its primary lithium operations are in Chile, where it is a longtime producer, and it is also working to bring production online in Australia.

In Chile, SQM sources brine from the Salar de Atacama; it then processes lithium chloride from the brine into lithium carbonate and hydroxide at its Salar del Carmen lithium plants located near Antofagasta.

Chile's aforementioned National Lithium Strategy has created some uncertainty for SQM, but the government has stated that it will respect its current contracts, which run through 2030. In May 2024, the state-owned mining company Codelco and SQM formed a joint venture in which Codelco will hold a 50 percent stake plus one share to give it majority control. As of 2031, the state will begin receiving 85 percent of the operating margin of the new production from SQM’s operations.

Outside of South America, SQM owns and operates the Mount Holland lithium mine and concentrator in Australia; the mine hosts one of the world’s largest hard-rock deposits. Mount Holland is a joint venture with Wesfarmers (ASX:WES,OTC Pink:WFAFF), which took over Australian lithium-mining company Kidman Resources in 2019.

Overall, the company sees its total sales volumes from all its lithium operations increasing by 15 percent this year.

SQM has a long-term supply deal with Hyundai (KRX:005380) and Kia (KRX:000270) to provide lithium hydroxide for electric vehicle batteries from its future lithium hydroxide supply. SQM also has supply agreements with Ford Motor Company (NYSE:F) and LG Energy (KRX:373220).

3. Ganfeng Lithium (OTC Pink:GNENF,SZSE:002460,HKEX:1772)

Market cap: US$7.5 billion

Share price: US$2.51

Founded in 2000 and listed in 2010, Ganfeng Lithium has operations across the entire electric vehicle battery supply chain. Even though it is relatively new compared to some companies on the list, Ganfeng has become one of the world’s largest producers of both lithium metals and lithium hydroxide. This is due to its strategy of investing heavily in overseas projects to secure long-term lithium resources, with its first such investment in 2014.

Ganfeng has interests in lithium resources around the world, from Australia to Argentina, China and Ireland; its operations include a 50/50 joint venture with Mineral Resources for the Mount Marion mine in Western Australia. In Argentina, the company has 51 percent stake in Lithium Americas’ (TSX:LAC,NYSE:LAC) Caucharí-Olaroz lithium brine project.

Ganfeng has a controlling interest in Mexico-focused Bacanora Lithium and its Sonora lithium project; it also has a 50 percent stake in a lithium mine in Mali, as well as a 49 percent stake in a salt lake project in China owned by China Minmetals. It owns the private company LitheA, which holds the rights to two lithium salt lakes in Argentina's Salta province.

Ganfeng purchased Leo Lithium’s (ASX:LLL,OTC Pink:LLLAF) Goulamina project in Mali in May 2024 and brought it into production in December. Goulamina has a mine capacity of 506,000 MT of spodumene per year. The company’s goal is to double that capacity to 1 million MT per year.

In February 2025, Ganfeng brought its US$790 million Mariana project in Argentina into production. The Mariana mine is situated on the Llullaillaco salt flat, and has the capacity to produce 20,000 MT of lithium chloride per year.

Ganfeng has supply deals with companies such as Tesla (NASDAQ:TSLA), BMW (OTC Pink:BMWYY,ETR:BMW), Korean battery maker LG Chem (KRX:051910), Volkswagen (OTC Pink:VLKAF,FWB:VOW) and Hyundai.

4. Albemarle (NYSE:ALB)

Market cap: US$6.92 billion

Share price: US$58.88

North Carolina-based Albemarle is dividing into two primary business units, one of which — the Albemarle Energy Storage unit — is focused wholly on the lithium-ion battery and energy transition markets. It includes the firm's lithium carbonate, hydroxide and metal production.

Albemarle has a broad portfolio of lithium mines and facilities, with extraction in Chile, Australia, China and the US. Looking first at Chile, Albemarle produces lithium carbonate at its La Negra lithium conversion plants, which process brine from the Salar de Atacama, the country’s largest salt flat. Albemarle is aiming to implement direct lithium extraction technology at the salt flat to reduce water usage.

Albemarle’s Australian assets includes the MARBL joint venture with Mineral Resources (ASX:MIN,OTC Pink:MALRF). The 50/50 JV owns and operates the Wodgina hard-rock lithium mine in Western Australia. Albemarle wholly owns the on-site Kemerton lithium hydroxide facility. The company’s other Australian joint venture is the aforementioned Greenbushes mine, in which it holds a 49 percent interest alongside Tianqi and IGO.

As for the US, Albemarle owns the Silver Peak lithium brine operations in Nevada's Clayton Valley, which is currently the country’s only source of lithium production. In its home state of North Carolina, Albemarle is planning to bring its past-producing Kings Mountain lithium mine back online, subject to permitting approval and a final investment decision. The mine is expected to produce around 420,000 MT of lithium-bearing spodumene concentrate annually.

Albemarle has received US$150 million in funding from the US government to support the building of a commercial-scale lithium concentrator facility on site. The US Department of Defense has given the company a US$90 million critical materials award to boost its domestic lithium production and support the country's burgeoning EV battery supply chain.

5. Tianqi Lithium (OTC Pink:TQLCF,SZSE:002466,HKEX:9696)

Market cap: US$6.61 billion

Share price: 30.26 Chinese yuan

Tianqi Lithium, a subsidiary of Chengdu Tianqi Industry Group, is the world’s largest hard-rock lithium producer. The company has assets in Australia, Chile and China. It holds a significant stake in SQM.

In Australia, Tianqi, as mentioned, has a significant position in the Greenbushes mine and Kwinana lithium hydroxide plant through the Tianqi Lithium Energy Australia JV with IGO. The hydroxide plant, which is one of the world's largest fully automated battery-grade lithium hydroxide facilities, processes feedstock from Greenbushes with a capacity of 24,000 MT per year.

Construction work for the Phase 2 expansion at Kwinana, which would have doubled its capacity, was terminated in January 2025 due to the current low-price environment for lithium making it economically unviable.

Tianqi Lithium Energy Australia updated the total mineral resources at Greenbushes in February 2025 to 440 million MT at an average grade of 1.5 percent lithium oxide, and its total ore reserve estimate to 172 million MT grading 1.9 percent lithium oxide.

In March 2025, Tianqi Lithium announced collaborations with a number of academic research institutions including the Institute for Advanced Materials and Technology of the University of Science and Technology Beijing on the research and development of next-generation solid-state battery materials and technology.

6. PLS (ASX:PLS,OTC Pink:PILBF)

Market cap: US$2.92 billion

Share price: AU$2.92

PLS, formerly named Pilbara Minerals, operates its 100 percent owned Pilgangoora lithium-tantalum asset in Western Australia. The operation entered commercial production in 2019 and consists of two processing plants: the Pilgan plant, located on the northern side of the Pilgangoora area, which produces a spodumene concentrate and a tantalite concentrate; and the Ngungaju plant, located to the south, which produces a spodumene concentrate.

PLS has recently completed a few critical expansion projects at Pilgangoora. Its P680 expansion, for a primary rejection facility and a crushing and ore-sorting facility, was completed in August 2024. The P1000 expansion, targeting a spodumene production increase at the site to 1 million MT per year, was completed in January 2025 ahead of schedule and within budget. The company says the ramp-up to full capacity is expected to be completed in the third quarter of 2025.

PLS and its joint venture partner Calix are developing a midstream demonstration plant at Pilgangoora using Calix's electric kiln technology to reduce the carbon footprint of spodumene processing, decreasing transport volumes and improving value-add processing at the mine. After garnering a AU$15 million grant from the Western Australian Government, construction of the project is expected to be completed in the fourth quarter of 2025.

The company made a move to expand its footprint in Brazil in August 2024 with the acquisition of Latin Resources (ASX:LRS,OTC Pink:LRSRF) and its Salinas lithium project. The project's resource estimate, which covers the Colina and Fog's Block deposits, stands at 77.7 million MT at 1.24 percent lithium oxide. The AU$560 million deal was approved by the Western Australia Government in January 2025.

PLS and joint venture partner POSCO (NYSE:PKX) launched South Korea's first lithium hydroxide processing plant in late 2024, which will be supplied with spodumene from Pilgangoora. PLS also has offtake agreements with companies such as Ganfeng, Chengxin Lithium Group, and Yibin Tianyi Lithium Industry.

7. Mineral Resources (ASX:MIN,OTC Pink:MALRF)

Market cap: US$2.59 billion

Share price: AU$18.95

Australia-based Mineral Resources (MinRes) is a commodities company that mines lithium and iron ore in the country. As mentioned, both of MinRes’ lithium mines are joint ventures with other companies on this list. In addition to the Wodgina mine in Western Australia, which is operated under the MARBL joint venture with Albemarle, MinRes holds a 50 percent stake in Albemarle's Qinzhou and Meishan plants in China.

MinRes owns 50 percent of the Mount Marion lithium operation, which is a joint venture with Ganfeng Lithium. Production of lithium concentrate began at Mount Marion in 2017, and all mining is managed by MinRes, which also has a 51 percent share of the output from the spodumene concentrator at the site. MinRes completed the expansion of Mount Marion's spodumene processing plant in 2023. Currently, the plant has an annual production capacity of 600,000 MT spodumene concentrate equivalent.

However, in late August 2024, in light of lithium's low demand environment, MinRes decided to reduce its operations at Mount Marion to between 150,000 and 170,000 MT of spodumene production in its financial year 2025 compared to the 218,000 metric tons of output achieved in its financial year 2024.

MinRes acquired the Bald Hill lithium mine, which is also located in Western Australia, in 2023. The company released an updated mineral resource estimate in November 2024 of 58.1 MT at 0.94 percent lithium oxide, up 168 percent from the prior June 2018 estimate. In the same news release, MinRes announced that it would have to place the mine on care and maintenance until global lithium prices improve. The final shipment of Bald Hill spodumene concentrate was made in December 2024.

Other lithium companies

Aside from the world’s top lithium producers, a number of other large lithium companies are producing this key electric vehicle raw material. These include Sigma Lithium (TSXV:SGML,NASDAQ:SGML), Liontown Resources (ASX:LTR,OTC Pink:LINRF), Jiangxi Special Electric Motor (SZSE:002176), Yongxing Special Materials Technology (SZSE:002756), Sinomine Resource (SZSE:002738) and Youngy (SZSE:002192).

FAQs for investing in lithium

Is lithium a metal?

Lithium is a soft, silver-white metal used in pharmaceuticals, ceramics, grease, lubricants and heat-resistant glass. It’s also used in lithium-ion batteries, which power everything from cell phones to laptops to electric vehicles.

How much lithium is there on Earth?

Lithium is the 33rd most abundant element in nature. According to the US Geological Survey, due to continuing exploration, identified lithium resources have increased to about 115 million metric tons worldwide. Global lithium reserves stand at 30 million MT, with production reaching 240,000 MT in 2024.

How is lithium produced?

Lithium is found in hard-rock deposits, evaporated brines and clay deposits. The largest hard-rock mine is Greenbushes in Australia, and most lithium brine output comes from salars in Chile and Argentina.

There are various types of lithium products, and many different applications for the mineral. After lithium is extracted from a deposit, it is often processed into lithium carbonate, lithium hydroxide or lithium metal. Battery-grade lithium carbonate and lithium hydroxide can be used to make cathode material for lithium-ion batteries.

What country produces the most lithium?

The latest data from the US Geological Survey shows that the world’s top lithium-producing countries are Australia, Chile and China, with production reaching 88,000 metric tons, 49,000 metric tons and 41,000 metric tons, respectively.

Global lithium production reached 240,000 metric tons of lithium in 2024, up from 204,000 MT in 2023, according to the US Geological Survey. About 87 percent of the lithium produced currently goes toward battery production, but other industries also consume the metal. For example, 5 percent is used in ceramics and glass, while 2 percent goes to lubricating greases.

Who is the largest miner of lithium?

The world's largest lithium-producing mine is Talison Lithium and Albemarle's Greenbushes hard-rock mine in Australia, which put out 1.38 million MT of spodumene concentrate in the fiscal year 2024. The top-producing lithium brine operation was SQM's Salar de Atacama operations in Chile, with 2023 production of 166,000 metric tons of lithium carbonate.

Who are the top lithium consumers?

The top lithium-importing country is China by a long shot, and second place South Korea is another significant importer. China is also the top country for lithium processing, and both are home to many companies producing lithium-ion batteries.

Why is lithium so hard to mine?

The different types of lithium deposits come with their own challenges.

For example, mining pegmatite lithium from hard-rock ore is known for being expensive, while extracting lithium from brines requires vast amounts of water and processing times that can sometimes be as long as 12 months. Lithium mining also comes with the difficulties associated with mining other minerals, such as long exploration and permitting periods.

What are the negative effects of lithium?

Both major forms of lithium mining can have negative effects on the environment. When it comes to hard-rock lithium mining, there have been incidents of chemicals leaking into the water supply and damaging the local ecosystems; in addition, these operations tend to have a large environmental footprint.

As mentioned, lithium brine extraction requires a lot of water for the evaporation process, but it's hard to understand the scope without numbers. It's estimated that approximately 2.2 million liters of water are required to produce 1 metric ton of lithium, and that can sometimes mean diverting water from communities that are experiencing drought conditions. This form of lithium extraction also affects the condition of the soil and air.

Will lithium run out?

Although future demand for lithium is expected to keep rising due to its role in green energy, the metal shouldn't run out any time soon, as companies are continuing to discover new lithium reserves and are developing more advanced extraction technologies. Additionally, there are companies working on technology to recycle battery metals, which will eventually allow lithium from lithium-ion batteries to re-enter the supply chain.

What technology will replace lithium?

Researchers have been working on developing and testing a variety of lithium alternatives for batteries. Some of these options include hydrogen batteries, liquid batteries that could be pumped into vehicles, batteries that replace lithium with sodium or magnesium and even batteries powered by sea water. While nothing looks ready to replace lithium-ion batteries right now, there is potential for more efficient or more environmentally friendly options to grow in popularity in the future.

How to buy a lithium stock?

Investors are starting to pay attention to the green energy transition and the raw materials that will enable it.

When it comes to choosing a stock to invest in, understanding lithium supply and demand dynamics is key, as there are unique factors to watch for in lithium stocks. The main demand driver for lithium is what happens in the electric vehicle industry, which is expected to keep growing, and also the energy storage space. Analysts remain optimistic about the future of lithium, with many predicting the market will be tight for some time.

Investors interested in lithium stocks could consider companies listed on US, Canadian and Australian stock exchanges. They can also check out our guide on what to look for in lithium stocks today.

This is an updated version of an article first published by the Investing News Network in 2016.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Melissa Pistilli, hold no direct investment interest in any company mentioned in this article.

Securities Disclosure: I, Georgia Williams, hold no direct investment interest in any company mentioned in this article.

Keep reading...Show less

24 April

Quarterly Activities/Appendix 5B Cash Flow Report

20 April

Galan Lithium

Investor Insight

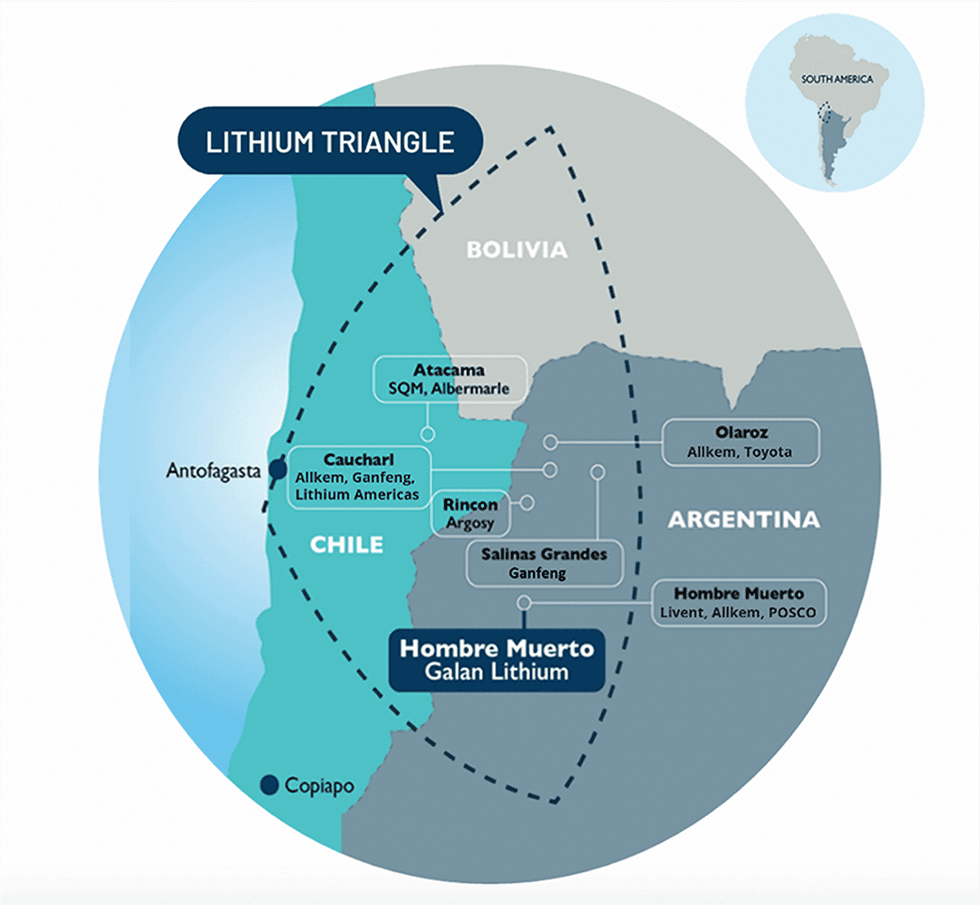

Galan Lithium’s investment appeal is driven by its Hombre Muerto West project, a top 20 global lithium resource featuring high-grade, low-cost lithium brine concentrate, on track for near-term production in Argentina’s renowned mining region.

Overview

Argentina is no stranger to lithium mining. The South American nation is one of three encompassed in the prolific Lithium Triangle, a region that holds more than 60 percent of the world’s lithium resources. Argentina has the world’s second greatest endowment of lithium reserves (17 Mt), concentrating lithium operations in the provinces of Jujuy, Salta and Catamarca.

Demand for lithium is forecasted to grow from approximately 1 Mt LCE in 2024 to around 3Mt in 2030, a compound annual growth rate of around 20 percent. Argentina has committed to $7 billion worth of investment for lithium production with strong growth projected for exports at $1.1 billion in 2023.

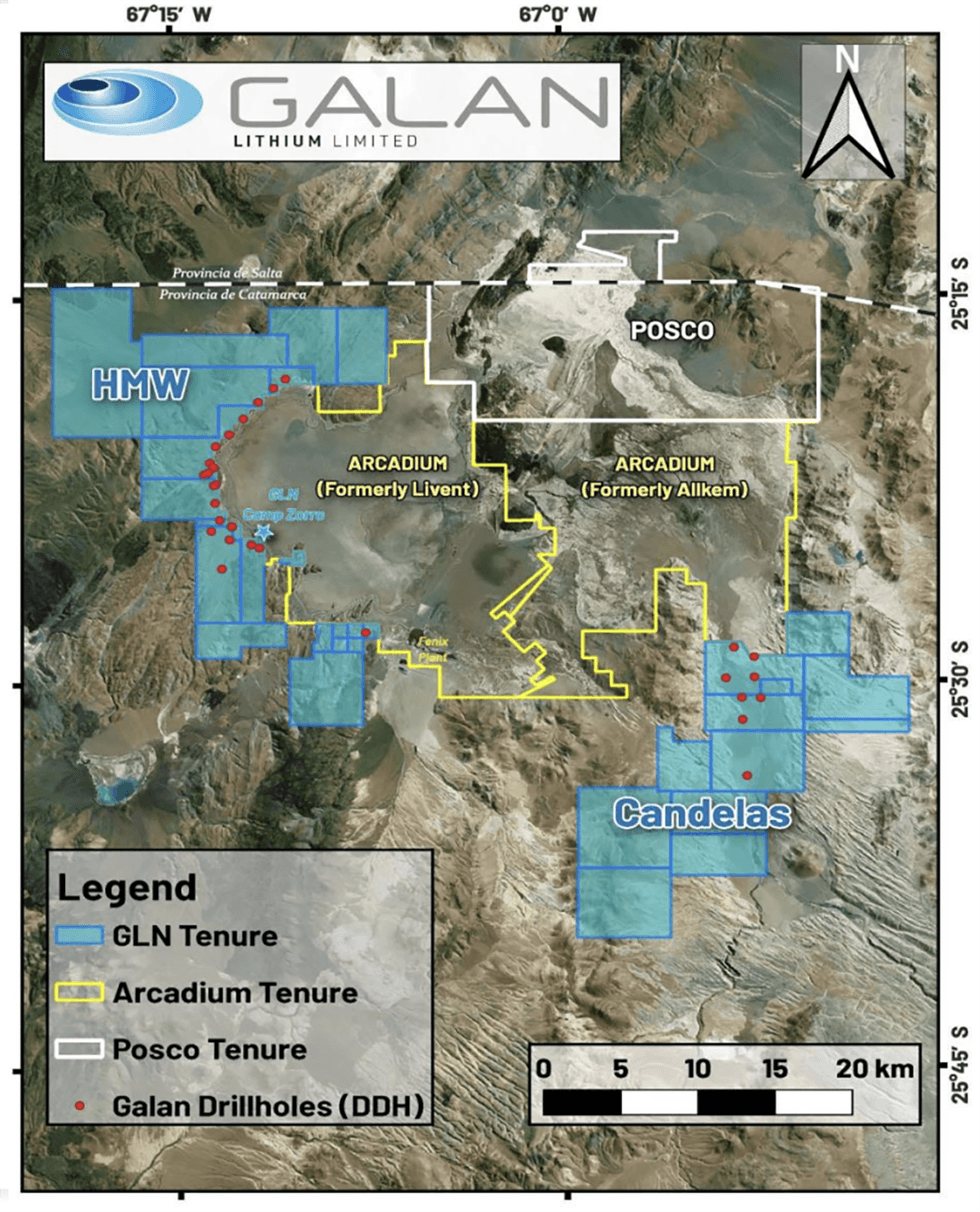

Galan Lithium (ASX:GLN,FSX:9CH) is an Australia-based international mining development company focused on its high-quality lithium brine projects in Argentina – Hombre Muerto West and Candelas. The company also holds a highly prospective lithium project in Australia – Greenbushes South.

The company’s flagship Hombre Muerto West (HMW) project hosts some of Argentina’s highest grade and lowest impurity levels with an inventory of 8.6 million tons (Mt) contained LCE @ 859 mg/L lithium, with 4.7 Mt contained LCE @ 866 mg/L Li in the measured category. The 100-percent-owned property is strategically located near Rio Tinto’s recently acquired Arcadium Lithium project, highlighting its position within a highly sought-after lithium region

Galan has signed a commercial agreement with the Catamarca Government supporting the grant of permits to enable the commercialisation of lithium chloride concentrate from HMW to be sold locally or exported internationally.

In August 2024, Galan entered into a memorandum of understanding with Chengdu Chemphys Chemical Industry Co. for an offtake prepayment agreement for the HMW project. Once a definitive agreement is executed, Chemphys will purchase a total of 23,000 tonnes lithium carbonate equivalent, as a lithium chloride product, over the first five years of production from Phase 1 of the HMW project. Chemphys will also provide Galan with an offtake prepayment facility to facilitate the continued development of Phase 1 of the HMW project.

The company also executed binding agreements with Authium Limited, securing a comprehensive funding and offtake package to support initial production from the Hombre Muerto West (HMW) Project. Under the agreements, Authium will fund, supply, and operate processing technology at HMW, significantly reducing Galan’s upfront capital and operating costs.

Catamarca Governor Raúl Jalil and Galan Lithium Managing Director Juan Pablo Vargas de la Vega in Catamarca.

In September 2024, Galan successfully completed a capital raising of AU$20 million, including a fully-subscribed Entitlement Offer of $13.3m, reflecting strong shareholder support and confidence in the Company’s strategic direction and the development of its HMW project

In addition to Hombre Muerto West, Galan Lithium’s portfolio includes several strategically positioned projects that complement its flagship asset:

- Candelas Project (Argentina): Located within the Hombre Muerto Basin, this underexplored project boasts a maiden resource estimate of 685kt LCE and is incorporated into Galan’s Phase 4 expansion plans targeting 60ktpa LCE production by 2030.

- Greenbushes South Project (Australia): Situated just 3 kilometres south of the world-class Greenbushes lithium mine, this project offers strong exploration potential for lithium-bearing pegmatites. Galan is progressing land access agreements and holds an exploration license through to 2029.

- James Bay & Ontario Projects (Canada): In 2023, Galan acquired property blocks in Quebec and Ontario located in globally recognized lithium provinces, providing further exploration upside in key jurisdictions.

Backed by a highly experienced management team, Galan is well-positioned to advance these complementary projects while maintaining its primary focus on developing HMW into a world-class lithium production hub.

Company Highlights

- Galan Lithium is an ASX-listed company developing lithium brine projects within South America’s lithium triangle on the Hombre Muerto salar in Argentina.

- The company has two high-quality projects in the works: its flagship Hombre Muerto West (HMW) and the Candelas lithium project, both in Argentina. The two projects combined bring the company’s current total mineral resource estimate to 8.6 million tons lithium carbonate equivalent @ 859 mg/L lithium.

- HMW leverages advantageous positioning near Arcadium Lithium’s project, which is subject to an acquisition by Rio Tinto, highlighting the strategic importance of this high-grade lithium region

- Galan’s lithium Resources are ranked among the top 20 in the world

- HMW sits in the lowest quartile of the global lithium cost curve, leveraging brine extraction advantages for cost efficiency

- High-grade, low-impurity brine concentrate validated by robust offtake interest and market alignment

- Galan’s phased approach and strong stakeholder collaboration mitigate risks and ensure steady progress toward first production in 2025

- The HMW Phase 1 (5.4 ktpa LCE) execution plan is progressing well with the delivery of the first evaporation-ready pond expected in 2024, and production in H2 2025.

- The HMW Phase 2 definitive feasibility study (DFS) delivers compelling economics with 21 kilo-tons per annum (ktpa) lithium carbonate equivalent (LCE) operation at HMW, targeting a high-quality, 6 percent concentrated lithium chloride product (equivalent to 12.9 percent lithium oxide or 31.9 percent LCE) in 2026.

- Galan has signed a commercial agreement with the Catamarca Government enabling the commercialisation of lithium chloride concentrate from HMW to be sold locally or exported internationally.

- Galan is the first mining company to apply for the Argentine ‘RIGI’, an incentive regime for large scale investments

- Galan is transitioning into a major lithium project developer and remains committed to conducting fast-tracked lithium development in its prolific projects with a target production of 60 ktpa LCE from HMW and Candelas by 2030.

Key Projects

Hombre Muerto West Project

The 100-percent-owned Hombre Muerto West project is a large land property that sits on the west coast of the Hombre Muerto salar in Argentina, the second-best salar in the world for the production of lithium from brines. The property also leverages strategic positioning near Arcadium Lithium, recently acquired by Rio Tinto.

Galan has increased HMW’s mineral resource to 8.6 Mt contained LCE @ 859 mg/L lithium (previously 7.3 Mt LCE @852 mg/L lithium), one of the highest grade resource estimates declared in Argentina. HMW’s measured resource is now at 4.7 Mt contained LCE @ 866mg/L lithium. Inclusion of the Catalina tenure adds ~1.3 Mt LCE to the HMW resource.

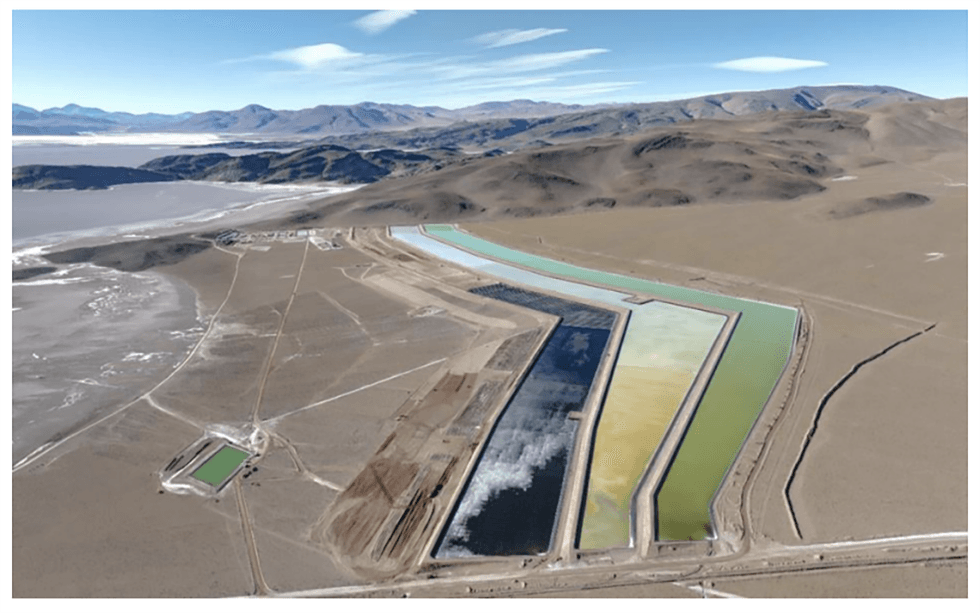

The pilot plant at HMW has validated the production of lithium chlorine concentrate, adding reagents to eliminate impurities, and generating a concentrate at 6 percent lithium. The plant comprises pre-concentration ponds, a lime plant, a filter press and concentration ponds.

Pilot Plant at HMW

Construction for Phase I has already commenced for 5.4 ktpa LCE production at HMW, and aims to deliver lithium chloride production in H2 2025. The fourth long-term pumping test (PBRS-03-23) results at HMW record an outstanding lithium mean grade of 981 mg/L - the highest reported grade from a production well in the Hombre Muerto Salar.

In October 2024, Galan announced 45 percent project completion with pond construction at 76 percent and project execution is advancing as planned.

A definitive feasibility study (DFS) for phase 2 shows a 20.85 ktpa LCE operation at HMW, targeting high-quality, 6 percent concentrated lithium chloride product (equivalent to 12.9 percent lithium oxide or 31.9 percent LCE) in 2026. The DFS also indicated phase 2 will deliver a post-tax NPV (8 percent) of US$2 billion, IRR of 43 percent and free cash flow of US$236 million per year. Phase 2 provides an exceptional foundation for significant economic upside in phases 3 and 4, targeting 60 ktpa LCE production by 2030.

Galan has entered into a memorandum of understanding with Chengdu Chemphys Chemical Industry Co. for a prepayment offtake agreement. Once a definitive agreement is executed, Chemphys will purchase a total of 23,000 tonnes of lithium carbonate equivalent, as a lithium chloride product, over the first five years of production from Phase 1 of the HMW project.

Chemphys will also provide Galan with a US$40 million offtake prepayment facility to facilitate the continued development of the HMW project.

The company has also signed binding agreements with Authium Limited, establishing a comprehensive funding and offtake package to support initial production at the Hombre Muerto West (HMW) Project. As part of the agreement, Authium will fund, supply, and operate the processing technology at HMW, materially lowering Galan’s upfront capital requirements and ongoing operating costs.

Galan now has 100 percent full ownership of the Catalina tenement that borders the Catamarca and Salta Provinces in Argentina. The newly secured Catalina tenure has a strong potential to significantly add to the existing HMW resource. The tenure also covers the Catalina, Rana de Sal II, Rana de Sal III, Pucara del Salar, Deseo I and Deceo II tenements.

Greenbushes South Lithium Project

The 100-percent-owned Greenbushes South lithium project is located near Perth, Western Australia, and is three kilometers south of the world-class Greenbushes lithium mine, managed by Talison Lithium. The Greenbushes South tenements can be found along the Donnybrook-Bridgetown Shear Zone geologic structure, which hosts the lithium-bearing pegmatites at the Greenbushes Lithium Mine.

Greenbushes South covers nearly 315 square kilometers, and hosts elevated pathfinder elements with well-defined anomalies adjacent to the property.

Management Team

Richard Homsany - Non-executive Chairman

Richard Homsany is an experienced corporate lawyer and has extensive board and operational experience in the resources and energy sectors. He is the executive chairman of ASX-listed uranium exploration and development company Toro Energy Limited, executive vice-president of Australia of TSX-listed uranium exploration company Mega Uranium and the principal of Cardinals Lawyers and Consultants, a boutique corporate and energy and resources law firm. He is also the chairman of the Health Insurance Fund of Australia (HIF) and listed Redstone Resources and Central Iron Ore and is a non-executive director of Brookside Energy Homsany’s past career includes time working at the Minera Alumbrera Copper and Gold mine located in the Catamarca Province, northwest Argentina.

Juan Pablo (‘JP’) Vargas de la Vega - Founder and Managing Director

Juan Pablo Vargas de la Vega is a Chilean/Australian mineral industry professional with 20 years of broad experience in ASX mining companies, stockbroking and private equity firms. JP founded Galan in late 2017. He has been a specialist lithium analyst in Australia, has also operated a private copper business in Chile and worked for BHP, Rio Tinto and Codelco.

Daniel Jimenez - Non-executive Director

Daniel Jimenez is a civil and industrial engineer and has worked for a world leader in the lithium industry, Sociedad Química y Minera de Chile, for over 28 years. He was the vice-president of sales of lithium, iodine and industrial chemicals where he formulated the commercial strategy and marketing of SQM’s industrial products and was responsible for over US$900 million worth of estimated sales in 2018.

Terry Gardiner - Non-executive Director

Terry Gardiner has 25 years’ experience in capital markets, stockbroking and derivatives trading. Prior to that, he had many years of trading in equities and derivatives for his family accounts. He is currently a director of boutique stockbroking firm Barclay Wells, a non-executive director of Cazaly Resources, and non-executive chairman of Charger Metals NL. He also holds non-executive positions with other ASX-listed entities.

María Claudia Pohl Ibáñez - Non-executive Director

María Claudia Pohl Ibáñez is an industrial civil industrial engineer with extensive experience in the lithium production industry. Until recently, she worked for world leader in the lithium industry Sociedad Química y Minera de Chile (NYSE:SQM, Santiago Stock Exchange:SQM-A, SQM-B) for 23 years, based in Santiago, Chile. During her time at SQM, she held numerous senior leadership roles including overseeing lithium planning and studies. Ibáñez brings significant lithium project evaluation and operational experience whilst joining the board at a critical juncture in Galan’s journey to becoming a significant South American lithium producer. Since leaving SQM in late 2021, Ibáñez has been managing partner and general manager of Chile-based Ad-Infinitum, a process engineering consultancy, with a specific focus on lithium brine projects under study and development, and the associated project evaluations.

Ross Dinsdale - Chief Financial Officer

Ross Dinsdale has 18 years of extensive experience across capital markets, equity research, investment banking and executive roles in the natural resources sector. He has held positions with Goldman Sachs, Azure Capital and more recently he acted as CFO for Mallee Resources. He is a CFA charter holder, has a Bachelor of Commerce and holds a Graduate Diploma in Applied Finance.

Keep reading...Show less

Latest News

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00

Investing News Network websites or approved third-party tools use cookies. Please refer to the cookie policy for collected data, privacy and GDPR compliance. By continuing to browse the site, you agree to our use of cookies.