U.S. Nasal Polyps Treatment Market Strengthens with Biologics & Recent Trials | DataM Intelligence

US Nasal Polyps Treatment Market

The U.S. nasal polyps drugs market is growing at 6% CAGR, bolstered by dupilumab efficacy and adolescent FDA approval.

NEW JERSEY, NJ, UNITED STATES, July 28, 2025 /EINPresswire.com/ -- U.S. Nasal Polyps Treatment Market Expands with Biologics & New Indications

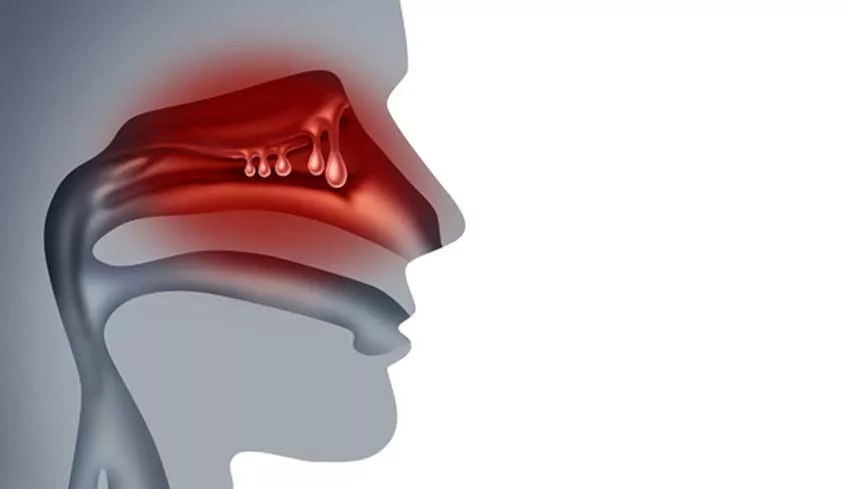

Chronic rhinosinusitis with nasal polyps (CRSwNP) remains a challenging inflammatory condition affecting nasal airflow, smell, and overall quality of life. According to DataM Intelligence analysis, the U.S. market for CRSwNP drugs is projected to grow at a CAGR of 6.0% through 2033, reaching an estimated USD 5.12 billion globally in 2033. North America dominates with over 42% market share in 2025, led by widespread adoption of biologic therapies like dupilumab and mepolizumab.

Download exclusive insights with our detailed sample report (Corporate Email ID gets priority access): https://www.datamintelligence.com/download-sample/u-s-nasal-polyps-treatment-market

Therapeutic Landscape & Biologics Momentum

Biologic Therapies Leading the Nasal Polyps Treatment Market

• Dupilumab (Dupixent), an IL 4/IL 13 inhibitor, is a cornerstone therapy for moderate-to-severe CRSwNP. In September 2024, the FDA expanded its approval to include adolescents aged 12–17, marking the first pediatric indication for nasal polyps treatment.

• Mepolizumab (Nucala), targeting IL 5, remains the first anti-IL 5 biologic approved in the U.S. for CRSwNP, mitigating polyp burden in eosinophilic patients.

Head to Head Trial Data

At the June 2025 EAACI congress, results from the EVEREST Phase 4 study showed dupilumab outperformed omalizumab (Xolair) in patients with CRSwNP and concomitant asthma, improving both polyp size and asthma control in as little as four weeks.

Market Drivers

• Premium efficacy of biologics: Dupilumab and mepolizumab significantly reduce the need for systemic corticosteroids and revision surgeries, enhancing both patient outcomes and cost-effectiveness.

• Pediatric approvals: Expansion to adolescents opens new patient segments and extends treatment duration across a patient’s lifespan.

• Rising real-world evidence: Observational reports show patients experiencing complete polyp resolution within months of initiating dupilumab therapy.

Recent Investments & Developments (U.S.)

• FDA Pediatric Indication (Sept 2024): Dupilumab became the first biologic approved for adolescents with CRSwNP, expanding market access and treatment penetration.

• Phase 4 Head-to-Head Success (June 2025): EVEREST data show superiority of dupilumab versus omalizumab, reinforcing physician confidence and supporting formulary inclusion.

Treatment Trends & Alternative Therapies

• Corticosteroids (intranasal and oral) remain first-line treatments—representing about 55% of current therapy usage—but are limited by recurrence and systemic side effects.

• Device-based options like Xhance (fluticasone delivered via exhalation system) offer improved delivery to targeted sinus regions and received FDA approval in 2024 for adult CRSwNP.

Looking for in-depth insights? Grab the full report: https://www.datamintelligence.com/buy-now-page?report=u-s-nasal-polyps-treatment-market

Challenges & Market Outlook

Challenges:

• High Biologic Costs: Dupilumab and mepolizumab are expensive, and insurance requirements—such as prior surgery before coverage, limit access for some patients.

• Long-term safety: Injection-associated risks like conjunctivitis, joint pain, and injection-site reactions may affect patient compliance.

Future Outlook:

• Pipeline Expansion: Emerging biologics like tezepelumab and broader bispecific antibody research are expected to enter clinical stages within the next two to three years.

• Improved access: As real-world data accumulate and biosimilars emerge post-2030, access and affordability could improve significantly.

Conclusion

According to DataM Intelligence analysis, the U.S. nasal polyps treatment market is poised for sustained growth. Biologics such as dupilumab and mepolizumab are transforming CRSwNP management across age groups, with recent pediatric approval and head-to-head efficacy data bolstering market momentum. While costs and coverage challenges remain, real-world patient outcomes and evolving therapies suggest that by 2033, biologics will command a higher share of patient care pathways.

Unlock 360° Market Intelligence with DataM Subscription Services: https://www.datamintelligence.com/reports-subscription

✅ Technology Roadmap Analysis

✅ Sustainability Impact Analysis

✅ KOL / Stakeholder Insights

✅ Pipeline Analysis For Drugs Discovery

✅ Positioning, Pricing & Market Access Snapshots

✅ Market Volatility & Emerging Risks Analysis

✅ Competitive Landscape

Have a look at our Subscription Dashboard: https://www.youtube.com/watch?v=x5oEiqEqTWg

Related Report

Nasal Polyps Treatment market to grow at a CAGR Of 6% during 2024-2031

Sinusitis Treatment Market to grow at a CAGR of 4% during 2024-2031

Sai Kumar

DataM Intelligence 4market Research LLP

+1 877-441-4866

sai.k@datamintelligence.com

Visit us on social media:

LinkedIn

X

Distribution channels: Healthcare & Pharmaceuticals Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release